28+ kpers retirement calculator

A projected retirement need and how much your 401k will contribute in income each month based on your current savings rate. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

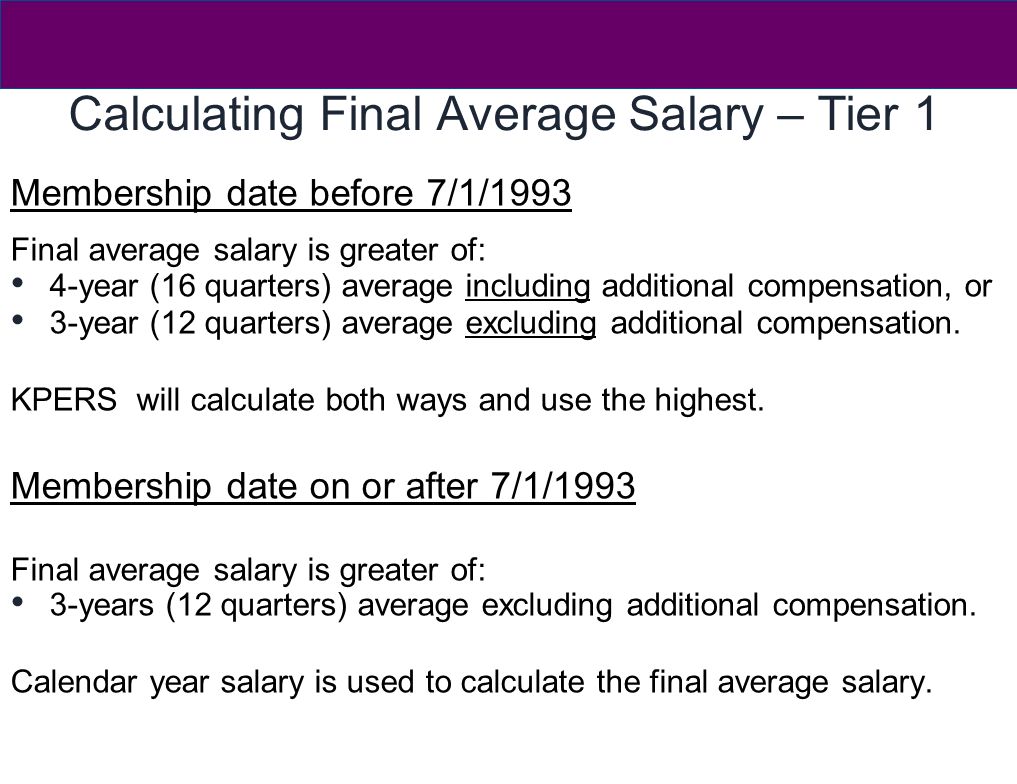

Making The Jump To Retirement 2011 Pre Retirement Seminar Kansas Public Employees Retirement System Ppt Download

Your Age Now Your Planned Retirement Age Your Life Expectancy Your Retirement.

. Discover Makes it Simple. Discover Bank Member FDIC. Web KPERS determines your contribution amounts and vesting timeframes based on your membership group.

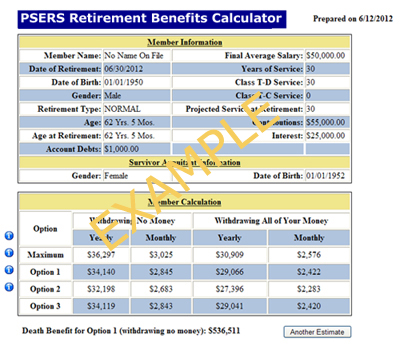

Web This calculation estimates the amount a person can withdraw every month in retirement. Login to your KPERS account to use pre-loaded information or enter the. The KPERS website provides complete information about the.

Ad Answer A Few Questions To Receive Guidance From AARPs Digital Retirement Coach. When you use our websites you agree to the terms and conditions published. Many financial advisors recommend a similar rate for.

Web The 401k calculator displays two results. Web Kansas Public Employees Retirement System KPERS Pension Plan. The benefit calculator uses a members personal data to create quick.

Web Financial services giant Fidelity suggests you should be saving at least 15 of your pre-tax salary for retirement. The AARPs Retirement Calculator Can Help. Web The amount you contributed from your salary to Kansas Public Employees Retirement System KPERS is subject to Kansas Income Tax.

Web Your KPERS Retirement Date is always on the 1st of the month. Web How to Avoid Taxes on a Lump Sum Pension Payout. Discover The Answers You Need Here.

Find Out If Youre Financially Prepared. Web The Kansas Public Employees Retirement System KPERS was established in 1961 for State of Kansas public employees to provide a defined benefit pension plan. On Page 13 Part D your signature needs to be.

Since the amount contributed is not. Web Calculating Your Retirement Benefit. Build Your Future With A Firm That Has 85 Years Of Investing Experience.

Rolling Over a Retirement Plan or Transferring an Existing IRA. In Just 3 Minutes Get Your Personalized Retirement Savings Action Plan. Web The Kansas Public Employees Retirement System administers three statewide defined-benefit plans for state and local public employees.

Web KPERS is committed to responsible information handling practices and protecting private information. Throughout your career you contribute part of your salary to the Retirement System. Ad Open a Roth or Traditional IRA CD Today.

The System also oversees KPERS. Ad How Much Should You Save for Retirement. Thinking About Retirement Can Be Overwhelming.

Investors can avoid taxes on a lump sum pension payout by rolling over the proceeds into an individual. You cannot physically work in the month that you retire.

Things To Consider

State Of Kansas Voluntary Retirement Incentive Program Frequently

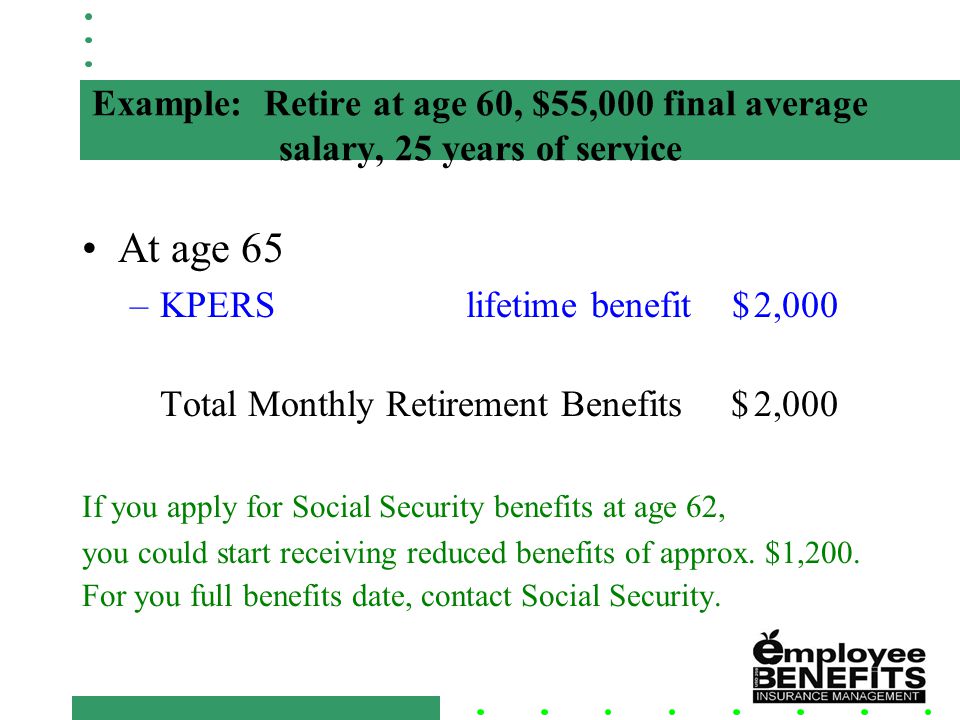

Usd 259 Retirement Seminar Ppt Video Online Download

![]()

Opers Financial Wellness Retirement Gap Calculator

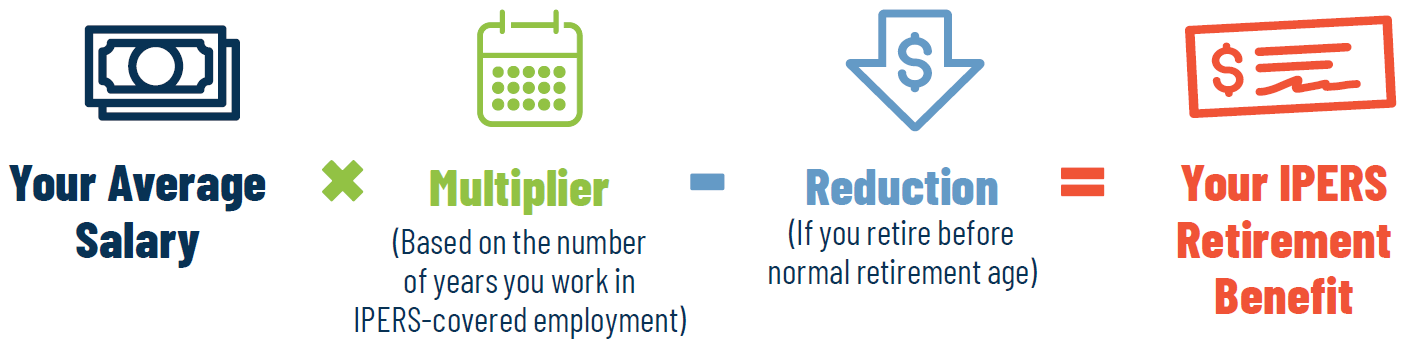

Retirement Benefit Calculation Ipers

Retirement Calculator Seen As Critical Tool Employee Benefit News

Solved Kpers Distributions Aren T Taxable Income In Ks Where S The Kansas Supplemental Schedule That Has Line A11 Retirement Benefits Specifically Exempt From Kansas Income Tax

Your Retirement Plan Piece By Piece

Lump Sum Vs Lifetime Monthly Payments What Should I Do With My Pension Ramsey

Usd 259 Retirement Seminar Ppt Video Online Download

Making The Jump To Retirement 2011 Pre Retirement Seminar Kansas Public Employees Retirement System Ppt Download

The Best Free Retirement Calculator Retire By 40

Best Retirement Calculator Personal Capital S Retirement Planner

Tools Calculators Modot Patrol Employees Retirement System

The Best Free Retirement Calculator Retire By 40

The Best Free Retirement Calculator Retire By 40

![]()

The 10 Best Retirement Calculators Newretirement